How to Beat the Inheritance Tax Squeeze: Protect Your Legacy

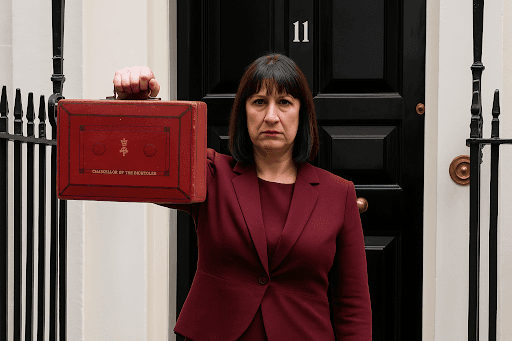

Many UK families face rising financial pressures, with the continued freeze of the inheritance tax (IHT) threshold causing concern.

Paul Markham

Senior Money Reporter

03 May 2025 8:22pm BST

This "stealth tax," coupled with rising property prices, means more estates are being drawn into the IHT net, potentially forcing families to sell assets.

IHT now affects a greater proportion of families. If your estate—including your home, savings, and investments—is valued over £325,000, the amount above that could be taxed at 40%.

For example, a £1.5 million estate could face an IHT bill of over £200,000, payable within six months of death. Experts predict IHT could affect 1 in 10 estates by 2030.

What's the solution?

Life insurance written in trust offers a strategic safeguard. This approach, used by many families, provides a tax-free payout outside your estate, helping cover the IHT bill and avoiding the stress of selling assets.

If you're worried about inheritance tax, planning ahead is key. To find out more and explore solutions, start at LetsGoCover. Their free service lets you quickly compare life insurance quotes that may be tax-efficient. Use their comparison tool to estimate your potential IHT bill and compare personalized quotes from top UK insurers.

To get started:

- Select your age below

- Answer a few short questions

- Get a free quote from leading broker LetsGoCover (4.9/5 on TrustPilot)